2022 941 Federal Tax Form has been updated:

The IRS has made more changes to the now very lengthy 941 form.

Because this form is so long, we have changed the 941 screen to move the most commonly used lines/boxes

to the upper portion of the window.

This means that the screen will not look exactly like the printed form.

This should make the window much more relevant and easy to access for

most users. Don't worry, you will still be able to print the EXACT forms to mail in.

The form will print on 3 separate pages(no back-side printing) with an option to print a Payment Voucher.

The information on this form is calculated based on Payroll entries. However, most of the boxes can be modified manually.

IF an amount has been modified by the user, the box color will change to YELLOW.

To Re-calculate or RESET the form information, click the CALCULATE button in the upper-right area of the window.

To see the detailed itemization of boxes 1,2,3,5a-e,6 or 16(all), Double-Click the box.

To see ALL of the detailed itemizations used to calculate the form, RIGHT-CLICK the CALCULATE button.

To view IRS 941 Instructions ->

https://www.irs.gov/pub/irs-pdf/i941.pdf

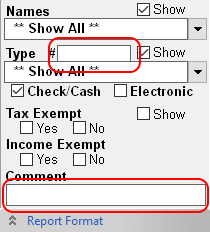

Note: 941 should NOT be filed if the only employee(s) are ministers and no Federal income tax has been withheld.

The minister's information will not appear on the 941 unless they are setup to have Federal Income taxes voluntarily withheld.

If you want to include the Minister on the 941 even though no Federal income taxes are withheld, then you will need to

add the Federal Income Tax to the Minister's Payroll.

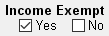

Click the TAX EXEMPT box if you do not want to actually withhold the tax.

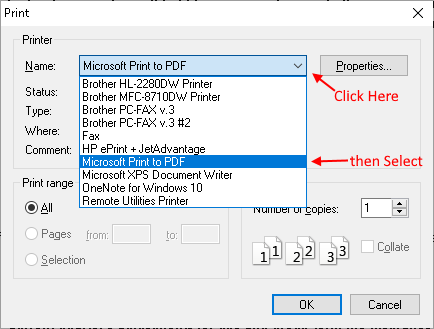

Printer Problems: If your printer is not printing the 941 forms correctly or is printing blank pages, you may

have an incompatibility problem with your Printer drivers. A good work-around solution is to print

to the MICROSOFT PDF PRINTER first. This will create a PDF file that you can print on your printer.

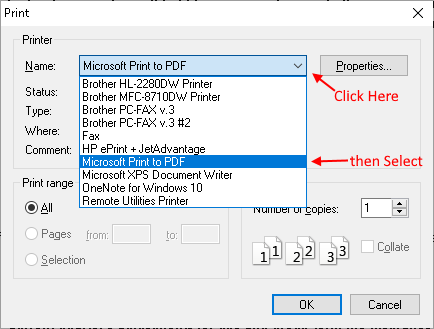

- Click the PRINT 941 button.

- Select the MICROSOFT PRINT TO PDF printer from the Printer Dialog, then click OK

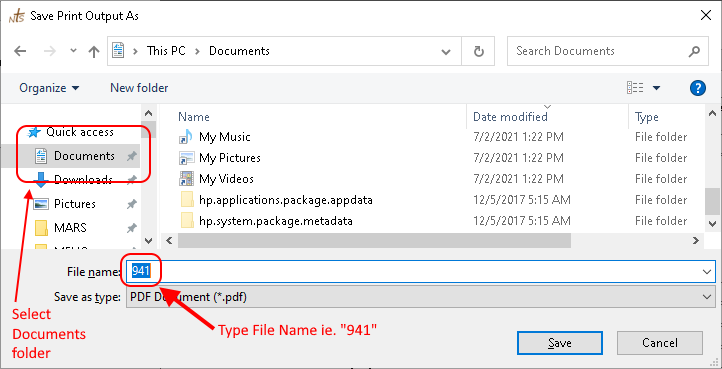

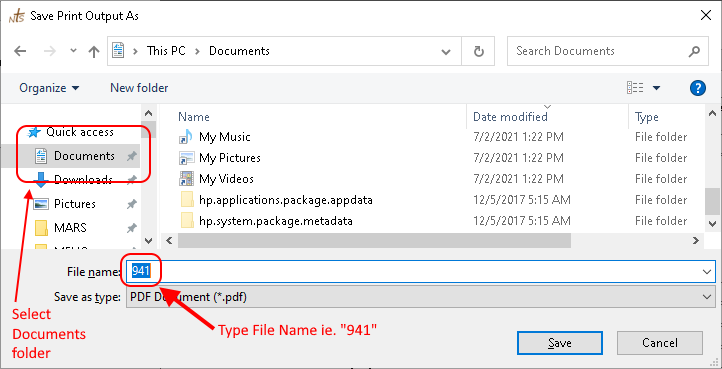

- Select the DOCUMENTS folder and then type the File name "941" and click SAVE

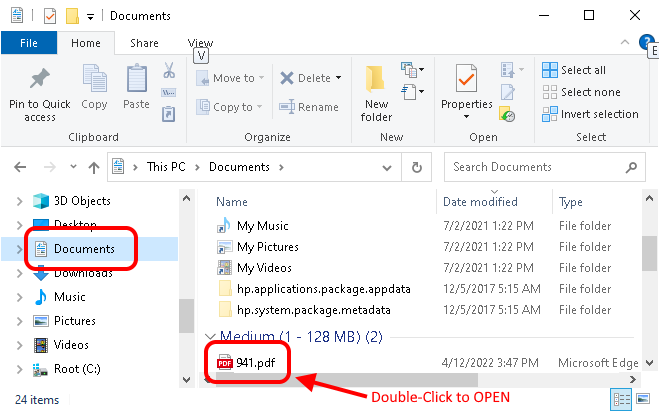

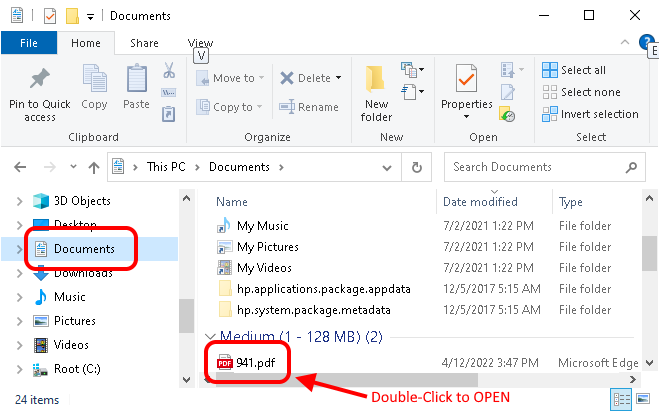

- Open the FILE EXPLORER app

- Select the DOCUMENTS folders and then DOUBLE-CLICK the 941.PDF file name/icon.

The 941 form will appear on the screen. (may take several seconds) Click the Printer icon and then choose your

NORMAL Printer from the Printer Dialog window. (Do not select MICROSOFT PRINT TO PDF again)

WHERE TO MAIL THE 941: Click here for 941 mailing locations.

End of version 6.149 changes