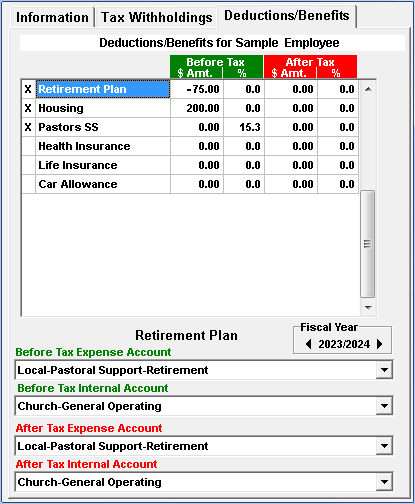

Different churches have different ways of compensating their pastors. Some churches will pay the pastor a straight salary. Others will pay the pastor a salary and other benefits such as a housing allowance or Social Security benefit. Ultimately, it is up to the pastor and the church board to determine how the pastor will be paid. In the graphic below, you will find examples of benefits that some churches pay their pastors. The benefits that are in the graphic are as follows: 1.) A deduction for a retirement plan of $75.00, 2.) A Housing allowance of $115.00, and 3.) A Social Security Benefit equal to 15.3% of his base salary. Each benefit list on this page is per pay period.

For the ministerial employee, the church should not withhold for Social Security/Medicare (FICA) taxes as it does for lay employees. For more information, see Memo #3 - Tax and Reporting Procedures from the Nazarene Pensions and Benefits web site. By clicking this link, you will leave the NTS web site.

The Nazarene Pensions and Benefits has additional information about how the pastor's salary can be structured. The links for this information follow. If you click on the following links, you will leave the NTS web site. The web sites are:

Memo #4: Strategies for Structuring Ministerial Compensation

For more information about pastor's salary, benefits, and payroll taxes, see the Nazarene Pensions and Benefits web site: Pensions and Benefits USA - Compensation and Tax Memos

Disclaimer:

The information contained in this web page is of a general nature. It is not offered as specific

legal or tax "advice." Each person, local church, and district should evaluate their own unique

situation in consultation with their local legal and tax advisors. We are not responsible for

the accuracy of information on other web sites including sites linked to from this page.