When changes are made to an Employee's Payroll Setup, these changes will only apply to future posted Payroll Checks. Previously posted Payroll Checks will have to be individually Edited in order to make changes to them.

Edit/Modify existing Paycheck information:

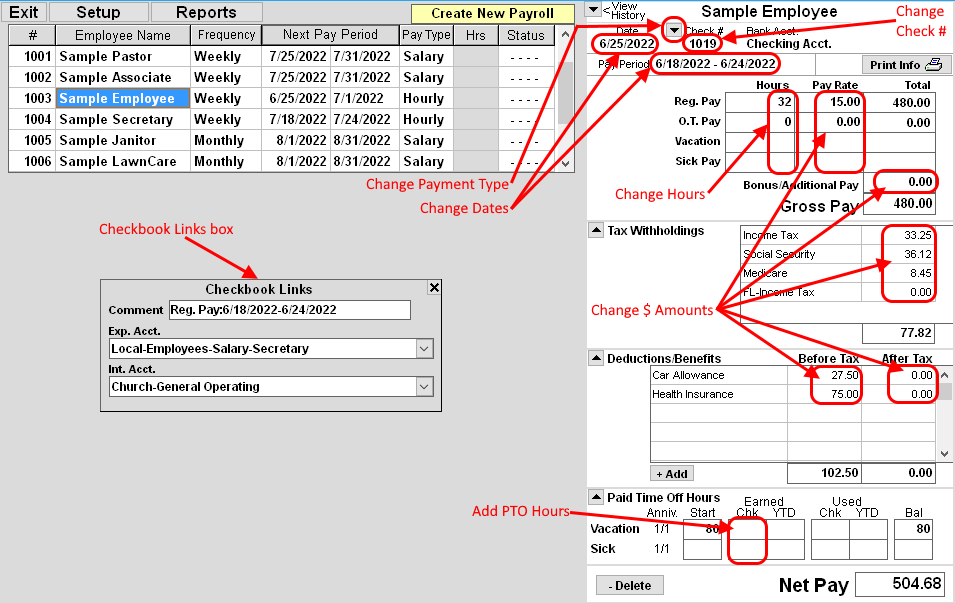

ALL changes will be made on the RIGHT-HALF of the window.

- Select/View the Payroll Check.

- To change the CHECK DATE or Pay period START/END DATES,

click on the DATE to change. {see image below}

Select Date on Pop-up Calendar. - To change the Check/E-Pmt number, click on the #,

then Enter the new #,

then press the ENTER key on the keyboard. - To change the Payment Type (Check/E-Pmt),

click the Down Arrow button(next to Check/E-Pmt #) and select from menu. - To change the Reg/OT Hours/Rate or Bonus/Additional Pay,

click inside the box to change and then enter the desired Hours/$ Amount,

then press the Enter key on the keyboard.

The Tax Withholdings will automatically be re-calculated. - To change a Tax Withholding or Deduction/Benefit Amount,

Click inside the applicable box and Enter the $ Amount,

then press the Enter on the keyboard.

You may be asked to Confirm updating the Tax Withholdings, if so, answer applicably. - To Add an additional Deduction/Benefit line,

click the +ADD button. (located below the box)

Click Here for information about adding additional Deduction/Benefits. - To Verify/Re-calculate Tax Withholdings:

Double-click TAX WITHHOLDINGS text. (top of Tax Withholdings box) - To Verify/Reset Deductions/Benefits Amounts:

Double-click BEFORE TAX or AFTER TAX text. (top of Deduction/Benefits box) - When clicking on any of the Payroll Amounts, a CHECKBOOK LINKS box will appear to the left.

This box will display the Checkbook Internal Account, Expense Account and Comment that are used for this Amount.

Click inside any of these boxes to modify the selection.

Click Here for information about changing these boxes.

The changes you make will be saved automatically.

For more information see: