The Add Deduction/Benefit feature allows additional Deductions/Benefits to be added to an existing Payroll Check.

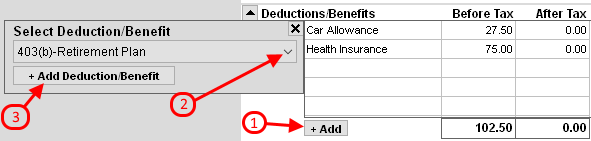

- Click the +Add button located at the bottom of the Deductions/Benefits box.

- Select the applicable Deduction/Benefits from the drop-down menu that appears.

- Click the "Add Deduction/Benefit" button to add the deduction or click the 'X' button in the upper left corner to Exit/Cancel.

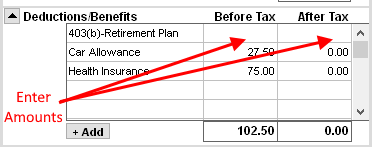

- The new Deduction/Benefit will appear in the Employee Deductions/Benefits box.

- Click inside the Before or After Tax box and type in the $ Amount of the Deduction/Benefit.

NOTE: Enter Deductions as a NEGATIVE amount. ie. -100.00

Press the ENTER key on the keyboard to complete the entry. - When clicking inside an amount box, the Checkbook Links box will appear to the left. Verify that

the Expense/Internal Accounts and Comment are correct. Make any necessary changes and then click the X

in the upper-right corner of the Links box.

Click Here for more information.

For more information see: