Overtime Pay or Second Hourly Job

The over time box can be used for paying an employee overtime or for paying an employee for a second job that is paid hourly. For setting up a normal overtime rate, please see employee setup. If the employee's second job is paid at an hourly rate, follow the same setup as for an overtime rate and then do the following when creating a new payroll check:

- Generate the employee's normal payroll check, only paying the employee for their regular number of hours or the hours for their first job.

- After the check has been generated, enter the number of overtime hours or the number of hours for the second job into the Overtime hours box.

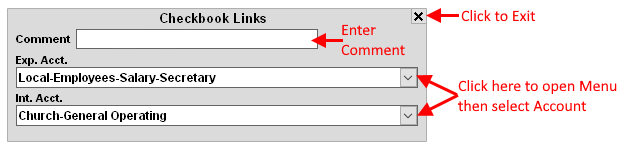

- If the second job needs to be paid from an expense or internal account different from the first job, change the expense/internal account link in the pop up "Link to Checkbook" box. You can also type in a different comment if you want a comment other than "OT Pay". See the illustration below.

Additional Pay or Second Salary Job

The Additional pay box can be used for a few different situations. Use this box if you under paid an employee on a prior check, need to pay a bonus or for paying an employee for a second job.

- Generate the employee's normal check.

- Type in the amount of additional pay.

- If pay needs to paid out of different expense/internal accounts, set the expense/internal accounts for the additional pay in the "Link to Checkbook" box. See the illustration below. You can also type in a different comment if you want a comment other than "Additional Pay".

NOTE: As with regular pay, taxes will be withheld from both overtime and additional pay.

For more information see: