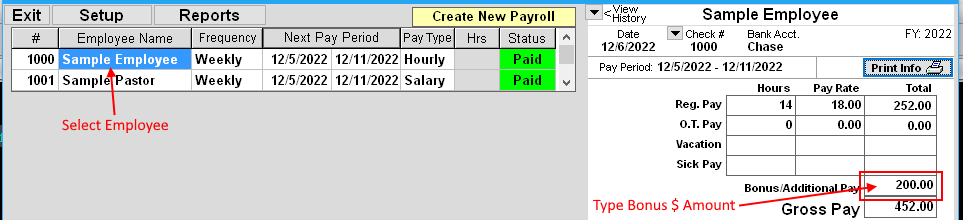

- Create Payroll Check(s) as you normally would. (Click HERE for Instructions)

- Select Employee

- Type Bonus $ Amount in the BONUS/ADDITIONAL PAY box, then press ENTER key.

- Tax withholdings will automatically re-calculate for Employees that have taxes withheld after adding the Bonus $ Amount.

Disclaimer:

The information contained in this web page is of a general nature. It is not offered as specific

legal or tax "advice." Each person, local church, and district should evaluate their own unique

situation in consultation with their local legal and tax advisors.