Note: Post Contributor Donations BEFORE posting the Deposit into the Checkbook. This will streamline the process.

Post the Deposit

- Select the Online Giving Bank Acct.(top-left of the Transaction Register) If you have not Setup a Bank Account for the Online Giving Acct, then CLICK HERE for instructions.

- Start a new Deposit entry by clicking the DEPOSIT button.

- Set the Deposit Date.

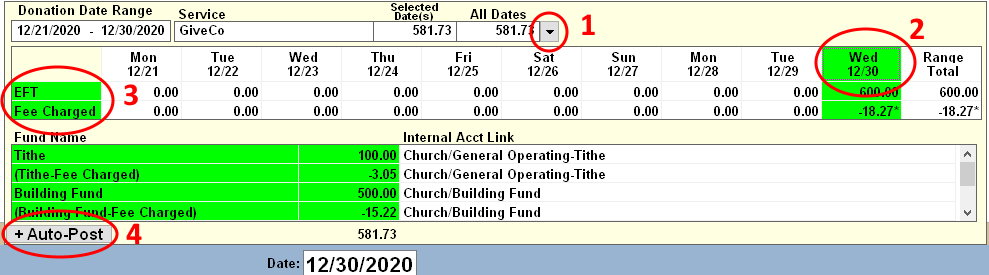

- The Donation Summary will appear listing recents donations.(see below)

- Select the Online Giving Service from the Drop-down menu.

- Click on the Day(s) that will be included in the Deposit. (will turn GREEN when selected)

- Make sure desired DONATION TYPES are selected.(ie. EFT and FEE CHARGED)

- Click AUTO-POST button

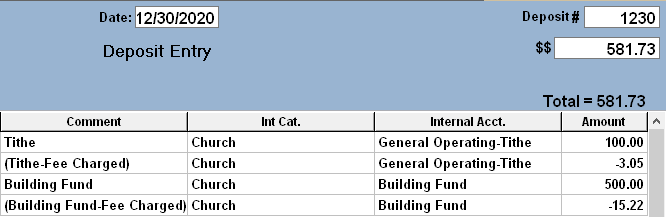

- Deposit information will fill-in

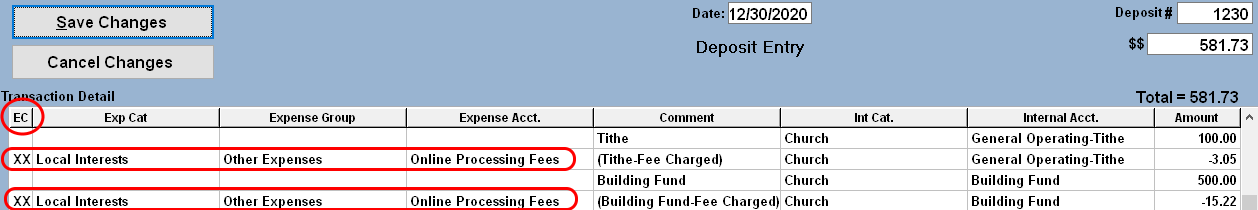

- Option: To show the Fees as Expenses rather than adjustments to Income:

- Double-Click the EC column on the row that contains the Fees.

- Choose the applicable Expense Category, Group and Account.

- Save the Deposit. (Click Save Changes)

For more detailed information see: