Related topic:

What is the difference between Expense Accounts and Internal Accounts

and how do they work together?

Internal Accounts are EARMARKED Fund accounts (sometimes referred to as "Designated" or "Restricted"). The purpose of an Internal Account is to keep track of the available balance and activity of a Fund, based on the income and expenses that are specifically related to it.

Internal Accounts receive income(balance increases) when a Deposit is posted because of a donation made to a Contribution Fund or when funds have been transferred from the General Operating Internal Account to be set aside for a specific use of the Funds. At this point the Funds become "Restricted/Designated" to be used for this particular purpose.

Internal Accounts disburse expenses(balance decreases) when a Check is posted because of an expense that is related to this Account.

An average size church will usually have about 3-10 Internal Accounts. A larger church will have more. It is best to keep the list of accounts as lean and relevant as possible. Too many accounts make the Internal Account list hard to manage and reports more difficult to read.

There are 2 criteria to use in order to determine if an Internal Account is needed:

- Do donors donate to this Fund or are Funds being set aside from the General Fund?

- Does the Fund Balance need to be tracked for at least 2 months before the balance is completely expended?

A typical church will have one primary Internal Account, usually named "General Operating-Tithe", that will serve as the account that receives credit when the Tithe and undesignated offerings are deposited. The normal operating expenses,(Salaries, utilities, etc), will also be deducted from this account. The account balance will always reflect what it available to be used for the General Operating expenses of the Church.

Donations that are of a short-term nature, like a Love Offering, do not need an Internal Account and can simply be credited and paid out of the "General Operating-Tithe" account. For example, if an offering is taken for a Special Speaker or Musician, then the donors would donate to a Contribution Fund named "Love Offering", but when the Deposit is posted, the Funds would be credited to the "General Operating-Tithe" Internal Account. Then when the Check is posted to pay the Special Speaker/Musician, the "General Operating-Tithe" account would be debited. The Comment field on the transactions would be used to explain the income/expense.

An Internal Account is needed if the church is specifically setting aside funds for some Specific Purpose/Project and wants to track this fund balance. For example, if the church wanted to send the Pastor to a National Convention that occurs every 4 years, then they may decide to take $50/month from the "General Operating-Tithe" Internal Account and put it into an Internal Account named "National Convention-Pastor". This would require creating the new Internal Account, and then posting a transaction to transfer the Funds each month.

Internal Accounts may be organized into Categories at the users discretion. Most churches have a primary Category named "Church" which contains the primary Internal Account "General Operating-Tithe" and others that are of a general nature.(Building Fund, Withholding Taxes, etc) Other categories are used to group related Internal Accounts. (ie. Christian Education, Youth, Missions, etc) Each Category will contain Internal Accounts that meet the 2 criteria mentioned above.

The internal accounts are just a different way of looking at the money contained within all of your bank accounts. Internal accounts are not tied to a specific bank account and neither are bank accounts tied to specific internal accounts.

Many times a church will set up a separate savings account for things such as a building fund. This can cause confusion if money is not properly transferred from the checking account to the savings account. The internal account Building Fund, and the Building Fund Savings account will not have the same balance unless the money is properly accounted for.

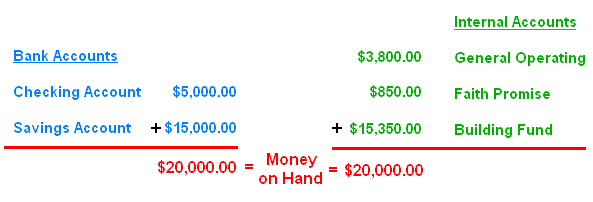

The following example should help you understand how internal accounts work.

Let's say that your church has two bank accounts, a Checking account and a Savings Account(used for Building Funds received). The current balance of the Checking account is $5,000.00 and the Savings account has a balance of $15,000.00. All together you have $20,000. Of the $5000.00 in the checking account, $3800 is regular tithes, and $850.00 was collected for Faith Promise. The remaining $350 is money received for the Building Fund, but deposited into the checking account instead of the Savings account. All $15,000.00 in the savings account is for the Building Fund. Let's now take a look at the balances of our internal and bank accounts.

The Building Fund Savings account only contains $15,000.00. But the total money in the Building Fund Internal Account is $15,350.00. As you can see, some of the money contributed for the Building Fund is in the checking account and some is in the Building Fund savings account. The internal accounts will tell you how much money you have to spend for each purpose. But, as far as the internal accounts are concerned, it does not make a difference what bank account the money is in. It is also important to note that the total balance of all your Internal Accounts will equal the total balance of all the Bank Accounts, as demonstrated above.