There are 3 methods that can be used to Transfer amounts between Bank Accounts:

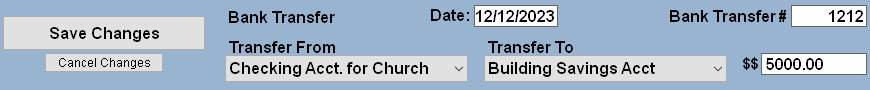

#1: BANK TRANSFER transaction

This is the simplest method and should be used when Internal Account balances do not need to change:

- Select either Bank Account involved from the Drop-down list above the Bank Register.

- Click the BANK TRANSFER button. (at left of Register)

- Specify the DATE and TRANSFER #

- Select the BANK ACCOUNT to be DEBITED/TRANSFERRED FROM in the drop-down Menu

- Select the BANK ACCOUNT to be CREDITED/TRANSFERRED TO in the drop-down Menu

- Specify the Transfer AMOUNT as a POSITIVE value

- Click the Save Changes button.

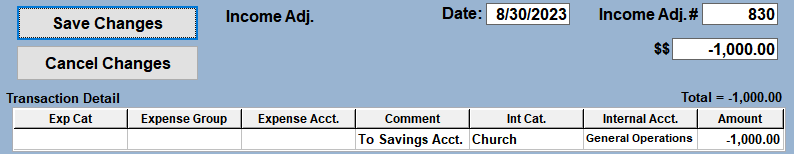

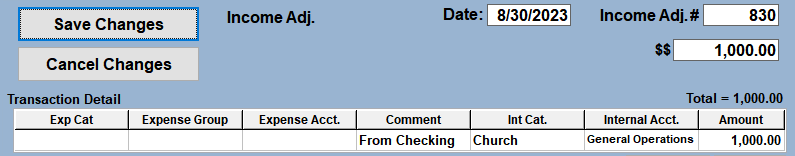

#2: INCOME ADJUSTMENT transactions

If you handle the Transfer of funds Online/Electronically or with Verbal Authorization, then use INCOME ADJUSTMENT transactions as follows:

- Select the Bank Account that funds are being withdrawn FROM.

- Click the Income Adjustment button to start a new transaction entry.

- Enter the Transfer Amount as a NEGATIVE amount. (preceded by an "-").

- Select the applicable INTERNAL CATEGORY and ACCOUNT and specify the same NEGATIVE Amount.

This will typically be the CHURCH / GENERAL OPERATIONS Account.

(Optional) Use the COMMENT field for additional explanation. - Click the Save Changes button to finish saving this Income Adjustment.

- Select the Bank Account that funds are being moved TO.

- Click the Income Adjustment button to start a new transaction entry.

- Enter the Transfer Amount as a POSITIVE amount. (do not need a "+")

- Select the applicable INTERNAL CATEGORY and ACCOUNT and specify the same Amount.

This will typically be the CHURCH / GENERAL OPERATIONS Account unless you are also moving funds to a different Internal Account.

(Optional) Use the COMMENT field for additional explanation. - Click the Save Changes button to finish saving this Income Adjustment.

#3: CHECK and DEPOSIT transactions

If you wrote a PAPER CHECK to withdraw the funds, then you will use the CHECK and DEPOSIT transactions as follows:

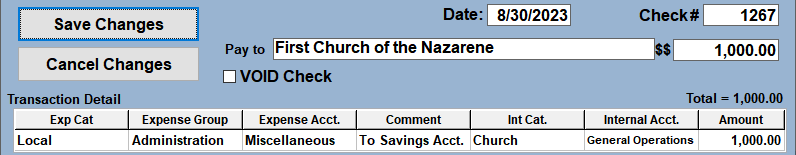

- Select the Bank Account that funds are being withdrawn FROM.

- Click the CHECK button to start a new transaction entry.

- Enter the Transfer Amount as normal. (no "-" needed).

- Select the applicable EXPENSE CATEGORY/GROUP/ACCOUNT and INTERNAL CATEGORY/ACCOUNT and

specify the same Amount.

This will typically be the LOCAL/ADMINISTRATION/MISCELLANEOUS Expense Account and the CHURCH/GENERAL OPERATIONS Internal Account.

(Optional) Use the COMMENT field for additional explanation. - Click the Save Changes button to finish saving this Check.

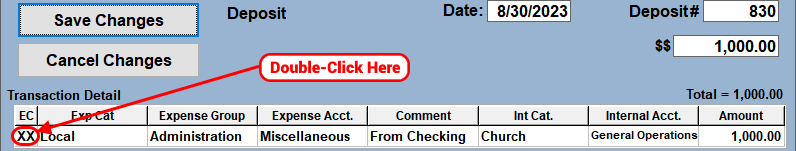

- Select the Bank Account that funds are being moved TO.

- Click the DEPOSIT button to start a new transaction entry.

- Enter the Transfer Amount as normal.

- Double-Click inside the EC column on the first Detail transaction row to gain access to the Expense Columns. You should see "XX" appear.

- Select the SAME EXPENSE CATEGORY/GROUP/ACCOUNT as selected above as well as the applicable

INTERNAL CATEGORY/ACCOUNT and then specify the same Amount.

This will typically be the LOCAL/ADMINISTRATION/MISCELLANEOUS Expense Account and the CHURCH/GENERAL OPERATIONS Internal Account unless you are also moving funds to a different Internal Account.

(Optional) Use the COMMENT field for additional explanation. - Click the Save Changes button to finish saving this Deposit.