When depositing a Refund or Reimbursement it is necessary to CREDIT the Expense Account(s) that were charged on the original Check/E-Check so that the total expenses for the year will be accurate.

This is a special situation that requires using the EXPENSE CREDIT feature.

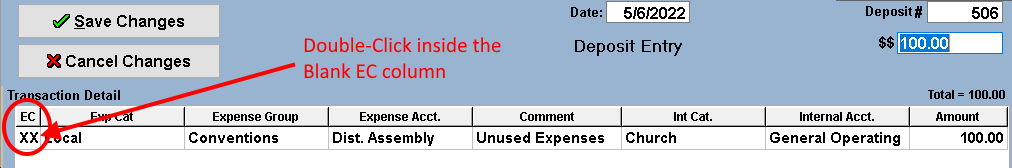

- Open a new deposit entry. In the transaction detail portion of the deposit, the left most column is labeled EC, which stands for EXPENSE CREDIT. Double click inside the blank box and 'XX' will appear.

- Select the SAME Expense Category/Group/Account used on the original Check/E-Check.

- Select the SAME Internal Category/Account used on the original Check/E-Check.

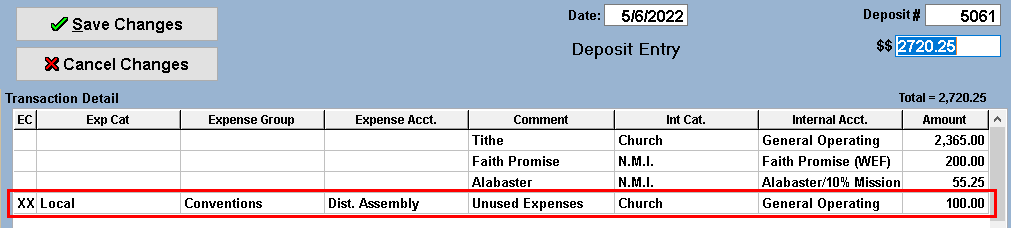

NOTE : Only use the Expense Credit feature on a Deposit for Refunds/Reimbursements (or sometimes In/Out Funds). DO NOT use the Expense Credit on a normal Deposit for things such as Tithe, designated offerings, Faith Promise, Building Fund, etc..

EXAMPLE #1: A Check was given to a person to pay for their District Assembly expenses in advance. After the District Assembly, the person returned the unused portion of the expenses ($100). These returned funds were then Deposited back into the Checking Acct and CREDITED back to the originally charged Expense and Internal Accounts.