- Setup the deduction in payroll. See Add a new deduction/benefit for instructions. Create a meaningful name for the deduction, such as Tithe.

- Go back to the Payroll setup and make the deduction active for your employee/pastor and enter the amount of the deduction.

- If the tithe should be included in taxable income, then this should be listed as an after tax deduction. If it is not to be included in taxable income, then it should be a before tax deduction.

- We suggest that the expense account for the deduction should be In/Out. The internal account should be Church - General Operating. For more information about setting up a deduction, see Payroll: Setup Deductions and Benefits.

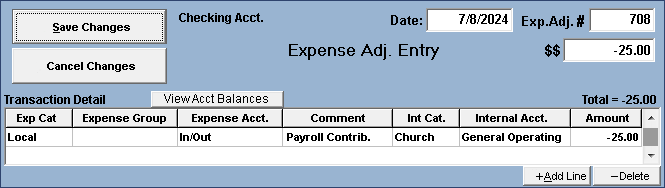

- Enter an Expense Adjustment for the tithe. The date on the adjustment should be the same as the date of the payroll check (step 1c. above). This will be a negative expense adjustment for the same amount as the payroll deduction. The expense account must be the same as the expense account selected in the setup for the deduction. Again, the internal account needs to be Church - General Operating. See the example below.

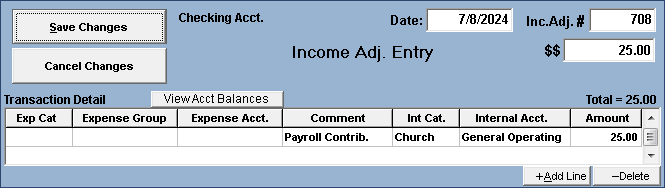

- Enter an Income Adjustment for the tithe. The adjustment will be positive and again for the same amount and date as the payroll deduction. This adjustment is going to act just like a deposit for the pastor's contribution. You will want to select the internal account that corresponds to the type of contribution the pastor wants to make. See the example below.

- This step is only for those who included the tithe in the taxable income. Post a contribution entry for the amount of the deduction. If the contribution falls within the dates of the Auto-Post Deposit, then you will need to reduce the amount of the deposit by the by the pastor's contribution. We recommend that you post the contribution on a day other than Sunday.

Disclaimer:

The information contained in this web page is of a general nature. It is not offered as specific

legal or tax "advice." Each person, local church, and district should evaluate their own unique

situation in consultation with their local legal and tax advisors.

For more information see: