- Create an expense account to be used as a liability account. A possible name for the account would be Credit Card Loan.

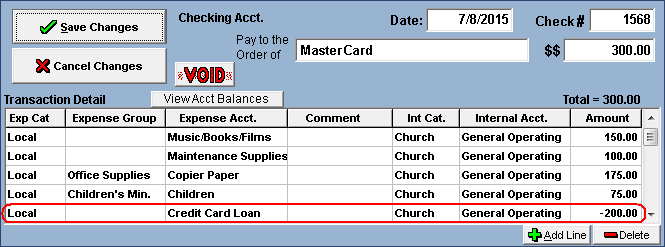

- On the check, post all expenses on the bill.

- Add an additional line and select the credit card loan expense account. For the internal account, select the Church - General Operating account.

- Enter as a negative amount the amount of the bill that is not going to be paid.

Example: the credit card bill is $500.00 but only $300.00 of the bill will be paid. That leaves a $200.00 balance. On the credit card loan line, enter "-200.00" See the example below.

To pay off the balance in subsequent months, select the credit card loan expense account and enter the amount you want to pay toward that debt. Then paying off the debt the amount would not be negative. Any interest could be charged to this account or some other expense account.

The Periodic Financial Report will show a negative amount for the Credit Card Loan expense account until the amount has been paid off. At which point, the amount would be zero unless interest was charged to the account. If the full amount is not paid by the end of the fiscal year, this account would need to be treated like and In/Out account. The amount that needs to be carried over to the next year is the remaining balance not that hasn't been paid. See the link below for more information.