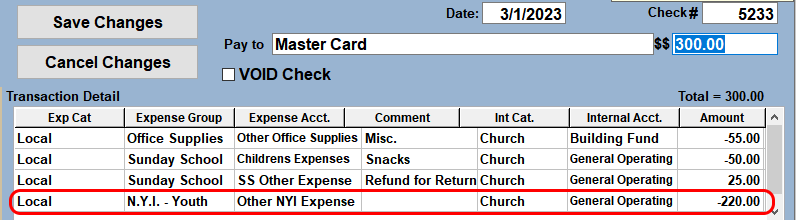

The refund will be recorded as a credit on the check. For example, the credit card bill has $100.00 in purchases and a $25.00 credit for a returned purchase. That leaves a total bill of $75.00.

- The total amount of the check in the example would be the $75.00 that is due. Type that amount into the check amount box ($$) box.

- Record the $100 in expenses just like it would normally be posted.

- Enter a line on the check for the credit. Charge the same expense and internal accounts as on the original check. In our example, the amount would be -25.00. See the illustration below.

- Save the check. This will credit back the refund to the appropriate accounts.

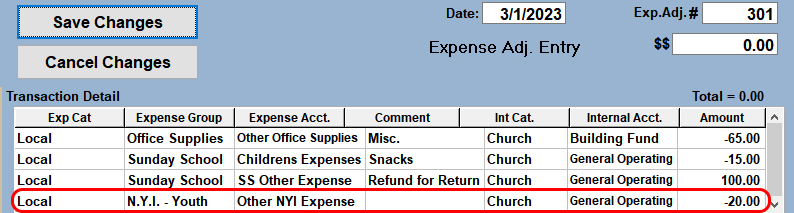

If the credit is for more than the total bill for the month, post an expense adjustment entry instead of a check.

- The amount of the adjustment will be $0.00.

- The transaction detail will look similar to the check in the above example. However, enter the regular expenses as negative amounts. See the illustration below.

- The credit will be listed as a positive amount and will be equal to the total expenses on the statement.

- Any excess credit will be applied to the next months bill. Follow the instructions above in the following month to account for any excess credit that could not be applied in the current month.