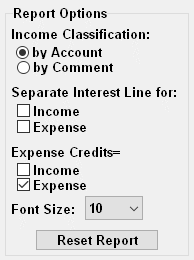

The Income/Expense amounts may be different depending on whether the Expense Credit (EC) Deposits have been classified as Income or Expense. If classifed as Income, then ALL Deposits will be included in the Income amounts. If classified as Expense, then the portion of Deposits marked as Expense Credits will be subtracted from the Income Amounts and added to the Expense Amounts. The NET change will be the same in either case.

For more information see: