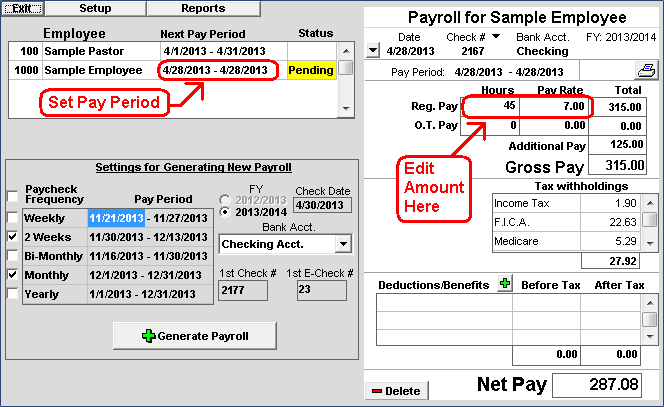

- Set the pay period next to the name of the employee that needs to be paid. To change the pay period, simply click on the start or end date to change it. An important concept to remember is that NTS will not allow you to generate 2 payroll checks for the same pay period. In this situation, we suggest you set the first and last day of the pay period on the supplement check to the last day of the pay period. See the example below.

- When you change pay period, the status will change to Pending.

- Click the Generate Payroll button.

- Edit the amount of the check. If the employee is paid hourly, change the number of hours on the check. If the employee is salary, simply change the pay rate to the amount that needs to be paid.

- Press Enter on your keyboard after making the changes.

- Since this is a supplemental check, the amounts of any deductions or benefits might need to be changed as well. Make any necessary changes to the deductions or benefits using the same method as for the pay rate.