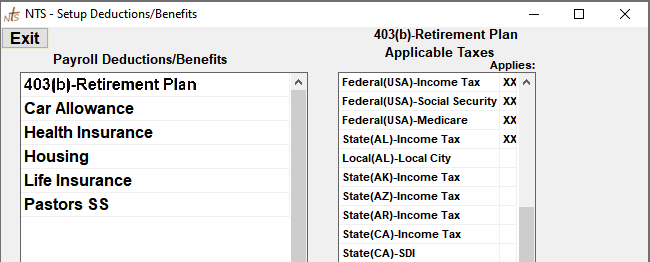

- From the Payroll screen, click on Setup. Next, click the Setup button at the top and then Deductions/Benefits.

- To Add a new deduction or benefit, click the Add Deduction/Benefit button. Type in the name of the new deduction or benefit. Click the Save Deduction/Benefit button.

- On the left side of the screen, note the Before-Tax and After-Tax boxes. In the $ Amount and Percentage (%) boxes, you can enter in a default amount or percentage for the deduction or benefit. In most cases, it would be best to leave these amounts as zero.

-

Locate the Taxes box. This box has a list of all taxes that could apply to the

deduction/benefit. Here you need to select the taxes that apply to the deduction or benefit. To

select a tax, double-click on the tax and 'XX' will appear next to the tax. In the example

below, Federal Income, Medicare, and FICA taxes are selected to apply to the new benefit.

- Taxable Benefit: Select all taxes that will apply to the benefit. These would be Before-Tax benefits.

- Non-taxable Benefit: These benefits should be After-Tax and therefore no taxes need to be selected.

- Taxable Deduction: These deductions should be After-Tax and therefore, no taxes need to be selected.

- Non-Taxable Deduction: Select all taxes that do not apply to the deduction. These would be Before-Tax deductions.

- To re-name an existing benefit or deduction, click on the name in the list and type in a new name.

To delete a deduction or benefit, click on the item in the list. Click the Delete Deduction/Benefit button. If the deduction or benefit is selected as active for any employee, the system will not allow you to delete the deduction or benefit. You would have to remove the deduction/benefit for all employees before you could delete it.