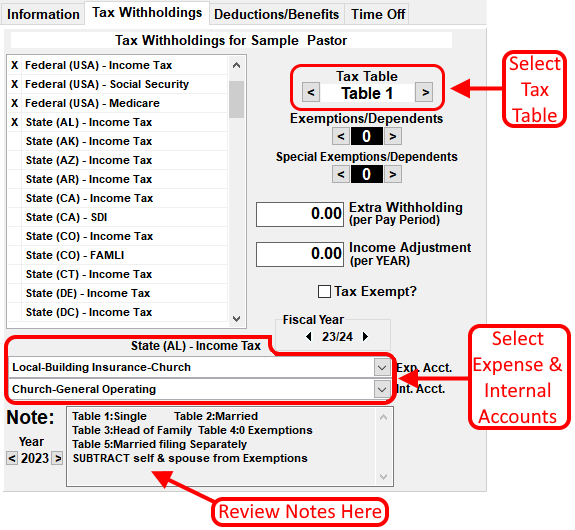

- At the top of the Payroll Setup screen (right side), click on the Tax Withholdings Tab. This tab will show a list of taxes with Federal Taxes listed first, followed by State and Local taxes. Only the taxes that are selected will be withheld from the employee's check.

- To select a tax to be withheld, double click on the name of the tax. This will produce an 'X' to the left of the tax. To de-select a tax, double click on the tax again.

-

After selecting a tax, you need to verify that all of settings for the tax are correct:

- Review the Note at the bottom of the window for information on which tax table should be used. The note will tell you how many tax tables are available and which one to use based on the employee's filling status (Form W-4) or the tax rate based on your locality. Use the right and left arrow buttons to change the tax table number as necessary.

- Select the number of exemptions and special exemptions by clicking the left or right arrow buttons.

- If extra withholding is requested, type in the extra amount in the "Extra Withholding $" box.

- Check the "Tax Exempt?" box if the employee is exempt from the tax withholding.

- Set the expense account and internal account links. In most cases, the expense account should correspond to the tax, example Local - Employees - Federal Income tax. The internal account should be an account specifically for withholding taxes, example, Church - Withholding Taxes.

- Repeat steps 2 and 3 for each tax.

Each time a payroll check is generated, the expense and internal accounts will be credited for each Withholding amount.

IMPORTANT NOTE: If an employee is not a minister and is exempt from Social Security and Medicare withholding, these taxes must be selected (Step 2) and the Tax Exempt box must be checked (Step 3.iv.)

Below is a link to the Nazarene General Church Pensions and Benefits web site that has information about payroll for pastors and employees.

Disclaimer:

The information contained in this web page is of a general nature. It is not offered as specific

legal or tax "advice." Each person, local church, and district should evaluate their own unique

situation in consultation with their local legal and tax advisors. We are not responsible for

the accuracy of information on other web sites including sites linked to from this page.