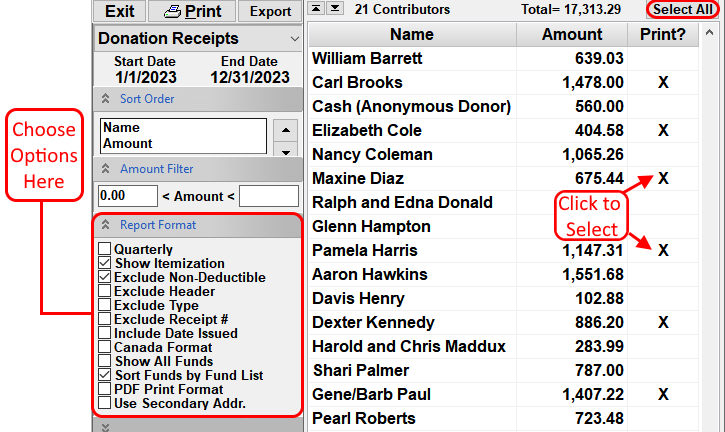

- From the Contributions Screen, click on Reports and then Receipts.

- The current calendar year will automatically be selected. To change the date range to a different year or time frame, click on the Start or End date buttons to change the dates.

-

There are multiple report format options available. Choose from the following options for the

receipts:

- Quarterly Format - This option will print the amount given on the receipt broken down by quarter. This option is selected by default. This can be used with any one year time frame that begins on the first of the month.

- Show Itemization - This option shows all contribution amounts by date, including the amounts necessary for IRS purposes. This option is checked by default.

- Exclude Non-Deductible - This option will exclude all non-deductible contributions. Non-Tax Deductible contributions will not be included on the receipt.

- Exclude Header - This option excludes the header section. The church name, address and phone number will not be printed. (For printing on letterhead paper)

- Exclude Type - This option excludes the contribution type (Check, Currency, Goods, etc) from the detailed listing of contributions.

- Exclude Receipt # - This option excludes the receipt # from the header. A receipt number will not be printed.

- Include Date Issued - Select this option to include the date issued or printed on the receipt.

- Canada Format - For Canadian churches, this option will print the information required by the Canada Revenue agency. The church's Charity BN/Registration # needs to be entered into the Federal ID box in the Church Information setup so that this number will be included on the receipt.

- Show All Funds - This option will print all funds on the contribution receipt, even funds that a contributor did not give any money to.

- Sort Funds by Fund List - By default, the funds are listed on the receipt in alphabetical order. Use this option to have the funds appear in the same order as in the fund list.

- Use Secondary Addr. - Check this option if you want to print receipts with the secondary instead of the primary address. The primary address will be used if a secondary address does not exist.

- Add Logo - See How do I add our logo? for instructions.

- To change to Receipt Title location: Click the Receipt Setting menu item on the left side of the screen and enter a different location in the Title Location (Inches) box. Enter, in inches, the distance from the top of the page to where the line should print.

- To customize the IRS goods and services statement: click the Receipt Setting menu item and then click Set IRS Statement button. Enter the statement you want to include and then click Save. This statement is required by the IRS for the contributions to be deductible on contributors tax returns. See IRS Publication 1771 for requirements if you want to change this statement.

- To Add Signature lines: Click the Check box(es) and type in signature line name

in the white signature line boxes.

Click here for information on using digital signature images - For information about mailing receipts to Contributors in windowed envelopes, see How do I setup Contribution Receipts for windowed envelopes?

- To print a receipt for every contributor listed, click the SELECT ALL button. Otherwise, Click on any name to select or unselect contributors. If using the arrow keys to move up and down the list, pressing the space bar will select or unselect contributors. To quickly find a contributor, press the first letter of their last name.

-

Click the

button in the upper left corner to print

the selected receipts.

button in the upper left corner to print

the selected receipts.

Print settings are saved when exiting this screen. The chosen settings will automatically be selected the next time this report is opened.

For more information see:

- How to Print Donation Statements [VIDEO]

- How to Setup Custom Digital Signatures on Contribution Statements or Reports

- How to Print Digital Signatures

- How to Setup the "Thank you" line at the bottom of the Donation Statement / Receipt

- How to Setup Donation Statements / Contribution Receipts for windowed envelopes

- How to Print Donor Name/Address Labels or Envelopes