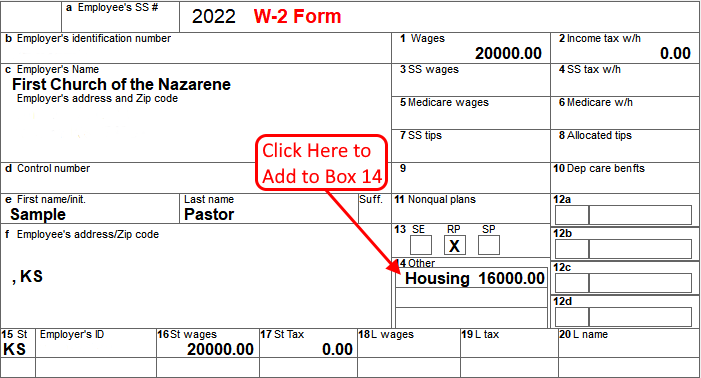

If Housing is paid through payroll, NTS will automatically include the housing amount in Box 14. Follow these instructions to add Housing for a parsonage or some other item to Box 14.

- Calculate the W-2 Forms. See Generating the W-2 Form if you need instructions on how to do this.

- Select the employee/pastor in the employee list.

- Click inside of Box 14 just below the number 14. See the example below.

- Type in the name of the compensation and then press the Tab key on your keyboard.

- Type in the amount of the compensation.

- Press the Tab key again and repeat steps 4 and 5 to include additional items in Box 14.

IMPORTANT: Anything typed into Box 14 is NOT saved. When you exit the W-2 Form, everything in box 14 will be erased and you will need to re-enter the information again if you need to print out the form. You should keep a paper copy of ALL forms submitted to the IRS. Do NOT expect that you will be able to reprint these forms from NTS at a later date.

Disclaimer:

The information contained in this web page is of a general nature. It is not offered as specific

legal or tax "advice." Each person, local church, and district should evaluate their own unique

situation in consultation with their local legal and tax advisors.