This is caused when a benefit has not been setup correctly. To change the tax settings, do the following:

- From the Payroll screen, click the Setup button.

- On the Payroll Setup screen, click the Setup button and then click Deductions/Benefits in the drop down list.

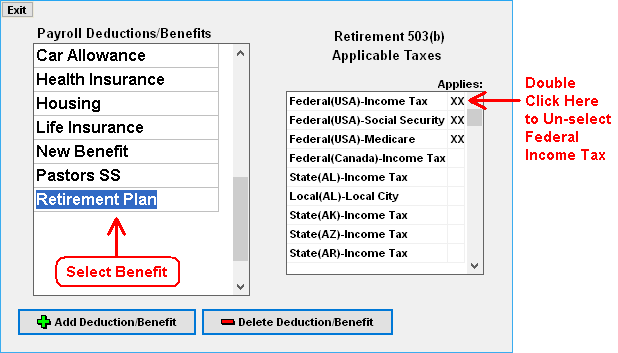

- Find the benefit in the list and click on it with the mouse to select it.

- In the green box that lists federal, state, and local taxes, find "Federal(USA)-Income Tax."

- There should not be a 'XX' in the "Applies to" column for Federal Income Tax. Double click on "Federal(USA)-Income Tax" to remove the 'XX'. See the illustration below.

After changing this setting and calculating the W-2 report again, the benefit will no longer be included as taxable income in Box 1.