Each deduction/benefit needs to be setup to be included in or excluded from the taxable income. The situations above typically indicate that one or more payroll benefits or deductions have not been setup correctly. The benefit/deduction is either included in or excluded from the state wages but not included in or excluded from the federal wages.

Take a look at the setup for your benefits to see what might need to be changed. The problem will only be with before tax benefits or deductions. After tax items will not effect the wages.

- From the Payroll screen, click Setup. On the Payroll Setup screen, click Setup and then Deductions/Benefits.

- On the next screen, click on one of the benefits or deductions that apply to the employee's pay.

-

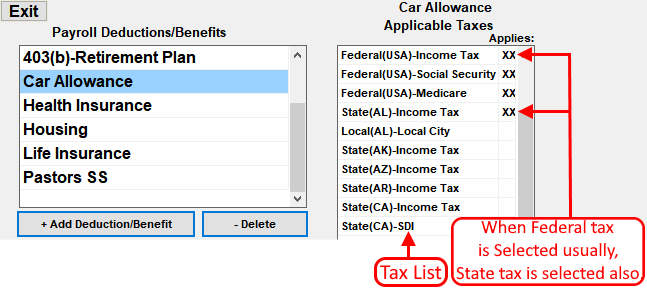

To the right of the Deduction/Benefits list, locate the list of taxes. See the example below.

In the list of taxes, there may be some taxes that have 'XX' to the left of the tax. When a tax is selected, it designates that the tax should apply to the benefit/deduction and that it should be added/subtracted from the taxable wages (box 1 or state wages box).When a benefit is selected, the amount of the benefit is added to the taxable wages. When a deduction is selected, the amount of the deduction is subtracted from the taxable wages. The reverse is also true. When a benefit is not selected, the amount of the benefit is not added to the taxable wages. When a deduction is not selected, the amount of the deduction not subtracted from the taxable wages. Remember, this only applies to before tax items.

- Verify that both Federal(USA)-Income Tax and the state tax (example: State(NY)-Income Tax) are either both marked with 'XX' or not marked. Both taxes should be marked or not marked depending on the taxability of the deduction/benefit. When one tax is marked and the other is not, it will result in differing state and federal wages. Scroll down in the list to find your state tax.

- Repeat steps 2 through 4 for each deduction or benefit applies to the employee's pay. Anything that does not apply to employee's pay can be ignored.

In the example below, Car Allowance has been selected. Federal(USA)-Income Tax has been selected but State(PA)-Income Tax is not selected. In this case, the Car Allowance would be included in Federal Box 1 wages but not included in the State Wages box for Pennsylvania. Either both should be checked or both should be unchecked so that state and federal wages will be the same.

Disclaimer:

The information contained in this web page is of a general nature. It is not offered as specific

legal or tax "advice." Each person, local church, and district should evaluate their own unique

situation in consultation with their local legal and tax advisors.