This check will be like a typical check. However, if you have a separate internal account for taxes withheld, then special attention will need to be paid to the way the check is posted. If a separate withholding taxes account is used, then the Social Security (or FICA) and Medicare taxes will need to be split between the Withholding Taxes account and the General Operating account. There needs to be a separate line item for taxes that were withheld from the employees check and the taxes that the church is responsible for.

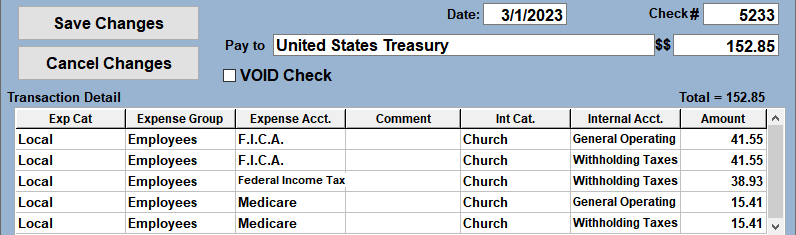

Charge Social Security and Medicare taxes withheld from the employees' checks to the Church Withholding Taxes internal account. For the portion of the taxes the church needs to pay, charge the Church General Operating or Tithe internal account. See the example below.

If you do not have a separate withholding taxes internal account, then typically the FICA and Medicare taxes can all be paid out of General Operating. In this case, you will not need to have split detail lines for these taxes. The FICA and Medicare lines, in the example below, can be combined into one line charged to General Operating.

Federal Income Tax is paid by the employee so all of this tax would be paid out of the Withholding Taxes account (or General Operating if you don't use a separate account.)

The 941 Liability Report provides the split amounts for the Social Security and Medicare taxes.