Using the method explained here, the original check will remain as is in the checkbook. Do NOT void or delete the original check.

- From the Checkbook screen, click the Expense Adjustment button. NOTE: Even if the transaction occurred in the prior fiscal year, enter the adjustment in the current fiscal year.

-

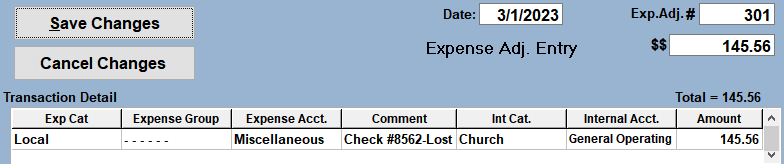

- Non-payroll Check: Enter in the amount of the check in the amount box, and then enter the transaction detail as it was originally posted. Below is an example of a lost check and the expense adjustment entry.

- Payroll Check: Enter the amount of the check in the amount box. In the transaction detail, enter one detail line and select the salary expense account for the employee. It is not necessary to list any tax withholdings, deductions, or benefits on the adjustment. For the internal account, choose the primary General Operating or Tithe account.

- If a check needs to be re-issued, post a new check in the checkbook in the current fiscal year. A replacement for a payroll check will also be posted in the checkbook as a regular check, not as a payroll check. The new check should use the same expense and internal accounts as on the adjustment entry in step 2. Posting the check and the adjustment entry in the current fiscal year keeps the expense in the prior year. The expense in the current year will be zero.

- The next time the bank account is reconciled, mark both the original check and the adjustment entry as reconciled. This should be done even if the original check was posted in the prior fiscal year. These transactions can also be added to the most recent report as opposed to waiting for the next bank statement.

Lost or Uncleared Check

Expense Adjustment Entry