- It is not necessary to post these types of proceeds on the Contributions screen, but it can be done if the user wishes. If doing so, then it is very important that the FUND credited for the proceeds is designated as NOT Tax-Deductible. Click Here for instructions.

- Add a new INTERNAL ACCOUNT, if one does not already exist, to separately account for the funds received, and name it accordingly. (ie. BUILDING LOAN or INSURANCE CLAIM)

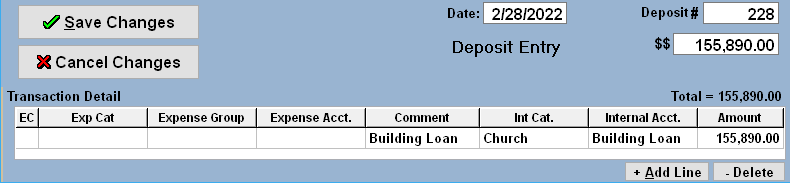

- Post a new DEPOSIT crediting the Internal Acct referenced above.

For more information see: